Are Professional Consultant Certificates still worth the risk for architects?

An architect practice recently reported an eleven-fold increase in the cost of its professional indemnity insurance as the fallout from the Grenfell Tower fire continues to shake up the market.

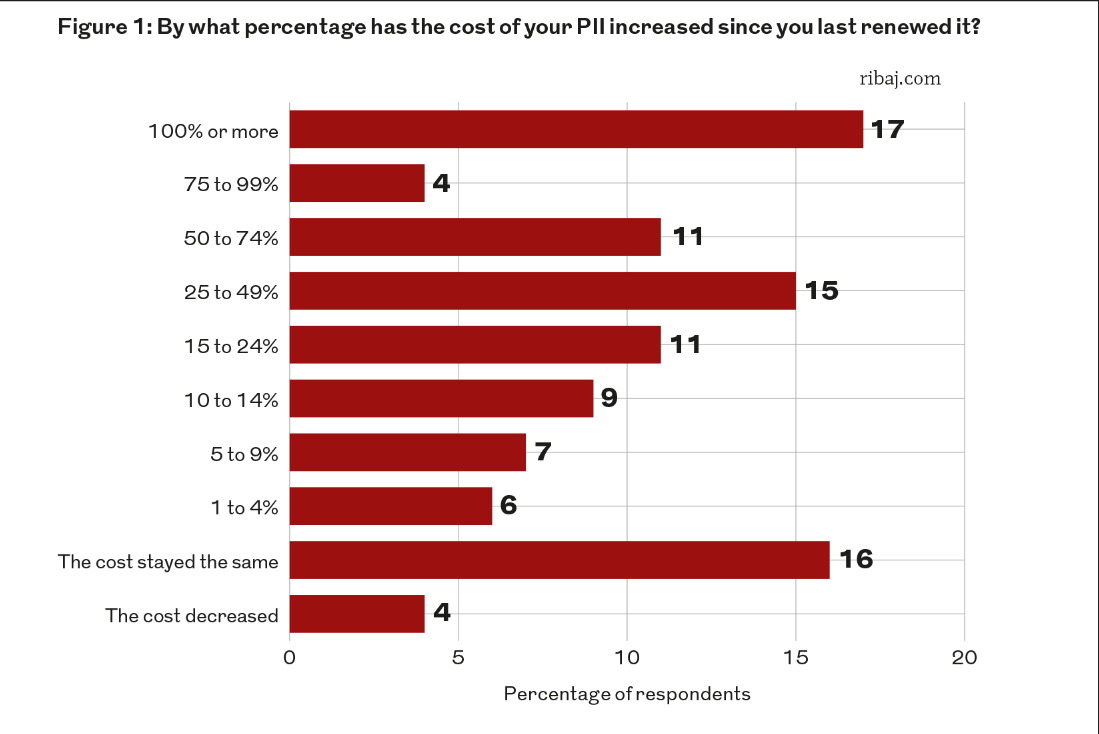

While most in the industry are aware of the astronomical cost increases, not everyone knows how steep the renewal increases are.

A survey ran by RIBA from June to early July 2021 indicated that the issue of PII increase is more than just an exorbitant business expense- it is a real threat to their business.

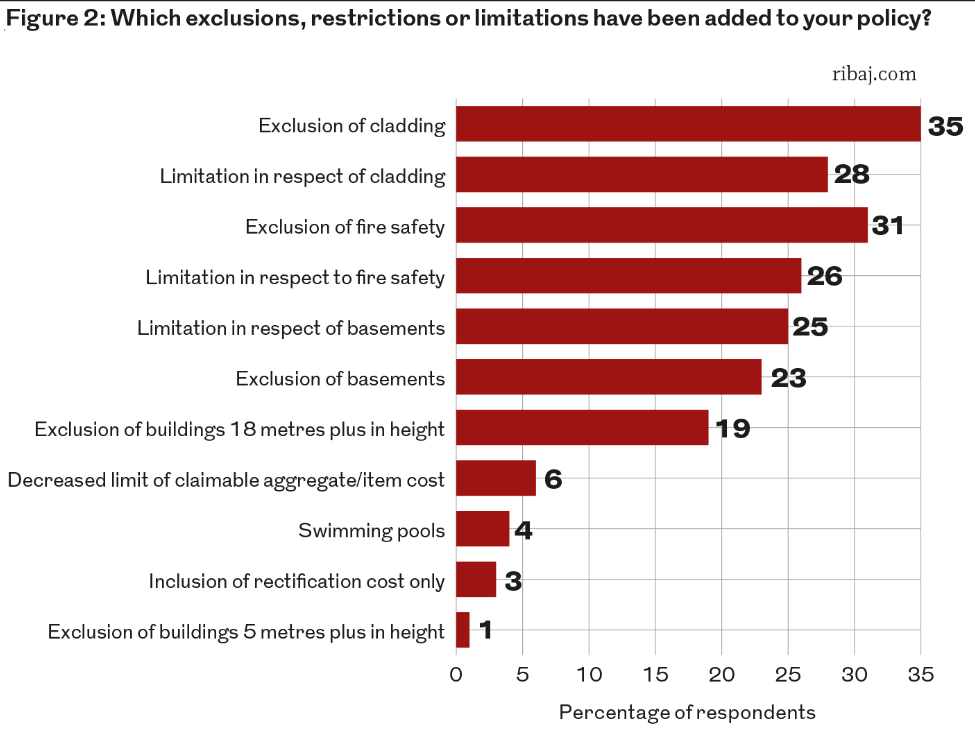

While there is rarely a choice but to pay the huge premium increases, the other concern is there are restrictive exclusions being applied to policies- some of these include: fire safety, cladding, basements, pools, and building height restrictions. This means that certain projects are now effectively ‘off the cards’ for some firms.

In addition, the consequences of the premium increase are even worse if there is a claims history- This is because indemnity is required from the insurer at the time the claim is being made rather than at the time when the error was made. Hence, insurers are extremely conscious and cautious about the business activity in the last six years, together with the relevant claims history.

A number of architect firms are now reviewing the merits of providing a Professional Consultants Certificate. While this certificate helps the developer with the sale of the unit, it doesn’t offer the same level of protection as an insurance-backed product.

Are PCCs worth the risk for architects?

Historically, architects would offer a PCC, but given the PII market conditions, many architects are now suggesting that developers source the additional protection that comes with a new building warranty.

A new build warranty offers more protection ie, ten years of cover versus six years with a PCC. It provides reduced risk and direct financial exposure from an architect’s perspective. In addition, a building warranty is more widely accepted by mortgage lenders.

There are often instances where homeowners are buying or selling properties without a building warranty in place- this is not only expensive

but also adds a great deal of time to the process, particularly if the end purchaser needs a mortgage to purchase the property. Purchasing a retrospective building warranty can be at least twice the price of the standard premium.

It is recommended to seek a warranty backed by A-rated capacity and, failing that explore the unrated warranty market. As an absolute last resort, consider a professional consultant certificate.